If you’re looking to break into homeownership but the price of single-family homes has you second-guessing, you might want to consider a condominium (condo) or townhome. These types of homes often come with a lower barrier to entry – and that can help you start to build equity and enjoy the benefits of owning a home sooner.

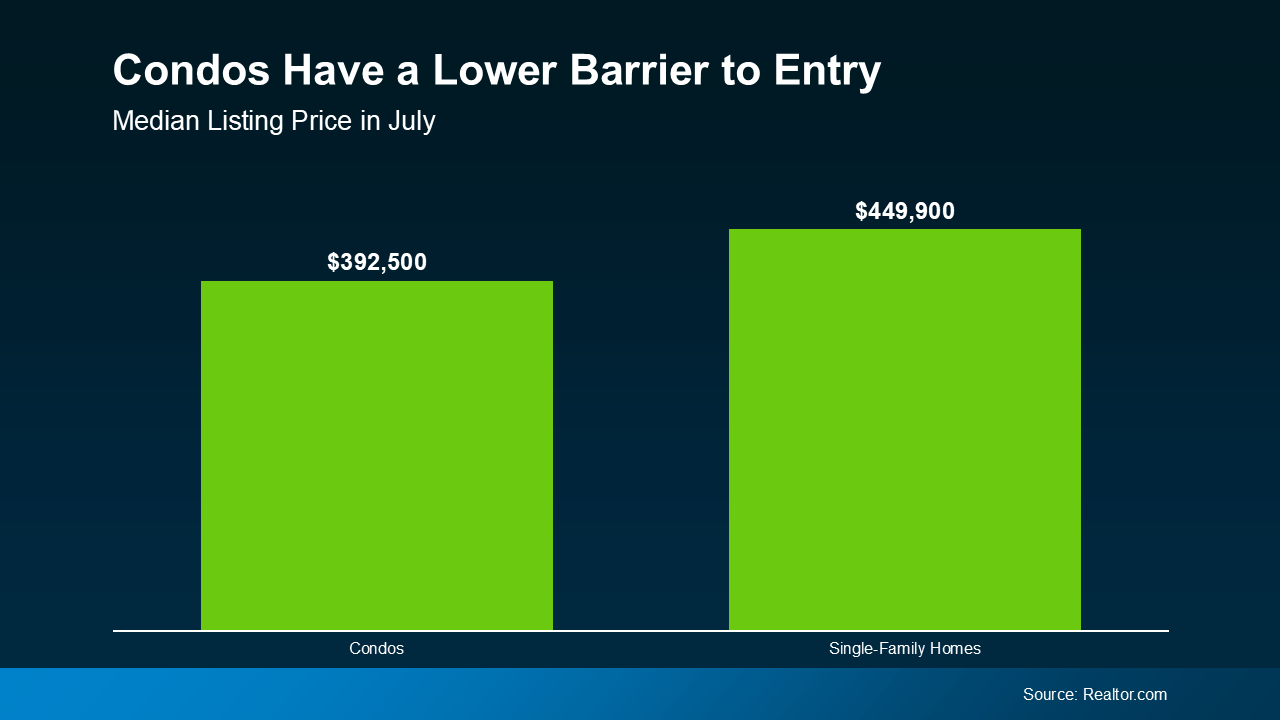

Since they're usually smaller than single-family homes, they can be easier on your wallet. While it’s not always the case, smaller square footage usually comes with a smaller price tag too. As a result, according to the latest data from Realtor.com, condos typically have a lower asking price than single-family homes (see graph below):

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

“The share of townhomes being built is at an all-time high.”

That means there’s a good number of options to add to your home search if you broaden it to include condos and townhomes. And you may even find something that works better for your budget.

So, if you're comfortable with a smaller space and want to buy your first home before the spring rush, adding these types of homes to your search might be your answer.

The Perks of a Condo Lifestyle

Living in a condo has a bunch of other perks, too. Let’s look closer at why condos are appealing for first-time buyers:

- They help you start building equity. When you buy a condo or townhome, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

- They can be low maintenance. Condos are great if you want to own your place but don't want to mow the lawn, shovel snow, or fix the roof. Your real estate agent can help explain any associated fees and details for the condos you’re interested in.

- They usually come with a range of amenities. Your condo might come with access to a pool, dog park, or parking. And the best part? You don’t have to take care of any of them.

- They create a sense of community. Buying a condo means you'll be living close to other people, which is nice if you want a more close-knit feel. Many communities like these hold fun events such as barbecues and parties to help create that sense of connection among residents.

Remember, your first home doesn't have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you want something different.

Ultimately, owning and living in a condo or townhome is a lifestyle choice. If you want to see if it makes sense for you, talk to a local real estate agent.

Bottom Line

Ready to find a home that suits your goals? A condo might be the perfect fit for your first home purchase. Let’s connect today to start your search.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.